Find Your Inner Peace at Sakura Yoga Academy

Discover authentic yoga in the heart of Tokyo. Join our community and embark on a journey of wellness and self-discovery.

Our Philosophy & Mission

Welcome to Sakura Yoga Academy, a serene oasis dedicated to fostering holistic wellness in the bustling heart of Tokyo. Nestled in the culturally rich district of Asakusa, our academy is more than just a yoga studio; it's a community hub where individuals from all walks of life come together to explore the profound benefits of yoga.

Founded on the principles of traditional yoga, we offer a diverse range of classes designed to cater to every body and every level of experience. Whether you are a seasoned yogi or stepping onto the mat for the very first time, our experienced instructors are here to guide you on your personal journey towards improved physical, mental, and spiritual well-being.

At Sakura Yoga Academy, we believe in the power of yoga to transform lives. We are committed to providing authentic and accessible yoga education, creating a space where everyone feels welcome, supported, and inspired. Our approach is rooted in mindfulness, compassion, and the deep understanding that yoga is not just about physical postures, but a holistic practice that integrates breath, body, and mind.

As a nonprofit organization, our mission extends beyond the walls of our studio. We are deeply committed to raising awareness about the vital importance of mental and physical health within the wider Tokyo community. We actively work to support local wellness initiatives, ensuring that the benefits of yoga are accessible to underserved populations who may not otherwise have the opportunity to experience this transformative practice.

By choosing Sakura Yoga Academy, you are not only investing in your own well-being but also contributing to a greater cause. A significant portion of our proceeds is dedicated to funding community outreach programs, providing free and subsidized yoga classes, workshops, and resources to those in need. We believe in giving back and making a positive impact on the lives of others through the practice of yoga.

Our commitment to authenticity means that we honor the rich heritage of yoga, drawing from ancient wisdom and time-tested techniques. We strive to create a learning environment that is both educational and nurturing, where students can deepen their understanding of yoga philosophy and practice in a supportive and encouraging atmosphere. We are dedicated to upholding the integrity of yoga while adapting it to the needs of our modern lives.

Community is at the heart of Sakura Yoga Academy. We foster a warm and inclusive environment where students can connect with like-minded individuals, build lasting friendships, and find a sense of belonging. We organize regular community events, workshops, and gatherings to strengthen these bonds and create a supportive network that extends beyond the yoga mat.

We are passionate about promoting holistic wellness, recognizing the interconnectedness of mind, body, and spirit. Our classes are designed to address all aspects of well-being, helping you to cultivate balance, resilience, and inner harmony. We offer a range of styles, from invigorating Vinyasa flow to deeply relaxing Restorative yoga, ensuring that there is something for everyone at every stage of their wellness journey.

Compassion is a guiding principle in everything we do. We approach our teaching and our community outreach with empathy, understanding, and a genuine desire to support the well-being of others. We believe in creating a safe and nurturing space where students feel comfortable exploring their practice and themselves without judgment.

Accessibility is a core value for us. We are committed to making yoga available to everyone, regardless of age, background, or physical ability. We offer classes at various times throughout the day to accommodate different schedules, and we strive to keep our prices affordable so that yoga is accessible to a wide range of people.

Core Values:

- Authenticity: Upholding the traditional teachings of yoga.

- Community: Building a supportive and inclusive environment.

- Wellness: Promoting holistic health for mind, body, and spirit.

- Compassion: Acting with empathy and understanding.

- Accessibility: Making yoga available to everyone.

Explore Our Diverse Classes

Hatha Yoga

Step into the foundational practice of Hatha Yoga, a discipline that harmonizes basic postures and breath control. Ideal for those new to yoga or seeking a practice that is both gentle and profoundly effective, Hatha Yoga at Sakura Academy provides a solid grounding in yogic principles. Our classes emphasize alignment, mindfulness, and cultivating a deep connection with your body. Experience a calming yet strengthening session that leaves you feeling balanced and centered, perfect for unwinding from the stresses of daily life in Tokyo and building a resilient foundation for your wellness journey.

View Schedule

Vinyasa Flow

Experience the dynamic energy of Vinyasa Flow, where breath and movement synchronize in a continuous, flowing sequence. This invigorating practice builds strength, enhances flexibility, and boosts stamina, making it an excellent choice for those seeking a more challenging and physically engaging yoga experience. Sakura Academy's Vinyasa Flow classes are designed to be adaptable, offering modifications for various levels, from intermediate to advanced practitioners. Feel your energy soar as you move through gracefully linked poses, cultivating focus and inner fire while sculpting your body and mind.

View Schedule

Prenatal Yoga

Nurture yourself and your baby with our specially crafted Prenatal Yoga classes. Designed for expectant mothers, these gentle sessions focus on movements, breathwork, and relaxation techniques that support a healthy pregnancy and prepare you for childbirth. Sakura Academy provides a safe and serene environment where you can connect with your changing body and your baby, alleviating common pregnancy discomforts and fostering a sense of calm and well-being. Join our community of expecting mothers to share this special journey together, strengthening your body and mind for the beautiful adventure of motherhood ahead.

View Schedule

Restorative Yoga

Indulge in profound relaxation with Restorative Yoga, a practice that uses props to support your body in comfortable postures, encouraging deep relaxation and stress reduction. Perfect for all levels, especially those seeking respite from the demands of a busy Tokyo lifestyle, Restorative Yoga at Sakura Academy offers a sanctuary of peace and tranquility. Melt away tension, soothe your nervous system, and rejuvenate your body and mind in these deeply nurturing sessions. Experience the healing power of stillness and emerge feeling refreshed, renewed, and utterly at ease.

View Schedule

Meditation Classes

Cultivate inner peace and mental clarity in our guided Meditation Classes. Suitable for everyone, regardless of prior experience, these sessions are designed to help you develop mindfulness, reduce stress, and enhance your overall mental well-being. In the serene setting of Sakura Academy, learn various meditation techniques, from breath awareness to visualization, and discover the transformative power of stillness. Find a refuge from the constant stimulation of Tokyo life, deepen your focus, and unlock a greater sense of calm and presence in your daily life.

View Schedule

Yoga Teacher Training

Embark on a profound journey of self-discovery and become a certified yoga instructor through our immersive Yoga Teacher Training program. Deepen your personal practice, gain comprehensive knowledge of yoga philosophy, anatomy, and teaching methodologies, and learn to share the gift of yoga with others. Sakura Academy offers a comprehensive curriculum led by experienced and passionate instructors, providing you with the skills and confidence to lead inspiring and safe yoga classes. Whether you aspire to teach professionally or simply want to enrich your understanding of yoga, our training program will transform your practice and your life.

Learn MoreOur Dedicated Yoga Instructors

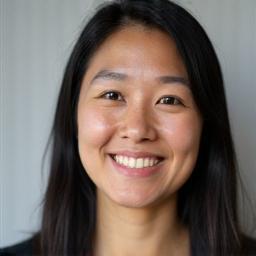

Aika Sato

Lead Instructor, Hatha & Restorative Yoga

Aika Sato has dedicated over 15 years to the practice of yoga and 10 years to sharing its profound benefits as a teacher. Her approach is gentle and nurturing, making yoga accessible and welcoming for students of all levels. Specializing in Hatha and Restorative Yoga, Aika's classes are deeply rooted in mindfulness, guiding students towards inner peace and tranquility. Her extensive experience and compassionate nature create a supportive environment where students can explore their practice with confidence and ease, fostering a deeper connection to themselves and the calming essence of yoga.

Kenji Tanaka

Vinyasa Flow & Meditation Instructor

Kenji Tanaka infuses his Vinyasa Flow classes with infectious energy and unwavering enthusiasm. With a solid background in sports science, Kenji brings a unique perspective to yoga, emphasizing proper alignment and building physical strength alongside flexibility. Beyond the physical practice, he is also a gifted meditation instructor, leading inspiring sessions that help students deepen their mental clarity and cultivate inner stillness. Kenji's dynamic teaching style and holistic approach make his classes both challenging and deeply rewarding, appealing to those seeking to integrate physical and mental well-being.

Yumi Nakamura

Prenatal & Gentle Yoga Specialist

Yumi Nakamura is passionately devoted to supporting women through all stages of life with the transformative power of yoga. As a specialist in Prenatal and Gentle Yoga, Yumi's classes are thoughtfully designed to nurture and empower women, creating a safe, supportive, and understanding space for every student. Her gentle yet effective approach is particularly beneficial for expectant mothers, providing them with the tools to navigate pregnancy with grace and strength. Yumi’s compassionate guidance helps women connect deeply with their bodies and their babies, fostering a sense of empowerment and well-being throughout their motherhood journey.

Student Success Stories

"Sakura Yoga Academy has truly transformed my life. From the moment I stepped into the studio, I felt a sense of peace and belonging. The instructors are not only incredibly skilled but also deeply supportive, always encouraging me to push my boundaries while honoring my body's needs. The community here is so welcoming; it feels like a second family. Every time I leave a class, I feel refreshed, centered, and ready to take on the world. Joining Sakura Yoga Academy was one of the best decisions I've ever made for my well-being."

- Aiko Mori

"I walked into Sakura Yoga Academy as a complete beginner, intimidated and unsure of what to expect. But from my very first class, I was met with warmth and encouragement. Now, just a few months later, I'm absolutely hooked! The classes are perfectly balanced – challenging enough to help me grow, yet accessible and adaptable to my level. I've noticed a huge improvement not only in my flexibility and strength but also in my ability to manage stress and find calm amidst the chaos of Tokyo life. I'm incredibly grateful for the positive changes Sakura Yoga Academy has brought into my life."

- Hiroshi Tanaka

"Prenatal yoga at Sakura Academy was an absolute lifesaver during my pregnancy. From the very first session, Yumi-sensei's expertise and nurturing approach made me feel incredibly supported and understood. Her classes were not just about physical exercise; they were a holistic preparation for childbirth, focusing on gentle movements, breathwork, and deep relaxation. I truly believe that my positive birthing experience was significantly influenced by the strength and calm I cultivated through prenatal yoga at Sakura Academy. I wholeheartedly recommend it to every expecting mother – it's a gift to yourself and your baby!"

- Sakura Lin

Weekly Class Schedule

| Day | 9:00 AM | 10:00 AM | 11:00 AM | 2:00 PM | 6:00 PM | 7:00 PM |

|---|---|---|---|---|---|---|

| Monday | Hatha Yoga Aika Sato |

- | - | - | Vinyasa Flow Kenji Tanaka |

- |

| Tuesday | - | Restorative Yoga Aika Sato |

- | - | - | Meditation Kenji Tanaka |

| Wednesday | Hatha Yoga Aika Sato |

- | - | - | Prenatal Yoga Yumi Nakamura |

- |

| Thursday | - | Restorative Yoga Aika Sato |

- | - | - | Vinyasa Flow Kenji Tanaka |

| Friday | Hatha Yoga Aika Sato |

- | - | - | Meditation Kenji Tanaka |

- |

| Saturday | - | Vinyasa Flow Kenji Tanaka |

- | Yoga Teacher Training (Info Session) Aika Sato |

- | - |

| Sunday | - | - | Restorative Yoga Yumi Nakamura |

- | - | - |

*Schedule is subject to change. Please check our online booking system for the most up-to-date information.

Our Studio Space

Get in Touch

We'd love to hear from you! For inquiries about classes, workshops, teacher training, or how to support our nonprofit mission, please reach out using the form below or contact us directly. At Sakura Yoga Academy, we are dedicated to making yoga accessible and beneficial for everyone in our community, and your support helps us expand our reach and impact.

Contact Information

Address: Sakura Yoga Academy, 2-15-8 Asakusa, Taito-ku, Tokyo, Tokyo, 111-0032, Japan

Phone: +81-3-5830-7200

Email: info@sakurayogaacademy.com

Common Questions

Start Your Yoga Journey Today

Join our community and experience the transformative benefits of yoga. Support our nonprofit mission by participating in our classes and events. Your journey to wellness and inner peace begins here at Sakura Yoga Academy.